AI + ASC: The Future of DeFi

The Development of and Challenges to ASC

DeFi and cryptocurrencies are inseparable from each other. As DeFi develops and matures, the cryptocurrency industry could experience a new round of growth driven by stablecoins. As a medium of exchange between fiat currency and crypto assets, stablecoins play a critical role in the crypto world. Currently, the market is craving for a way to make “stablecoins” truly stable. Generally speaking, price stability is achievable when there exists a mechanism to deplete the number of a stablecoin when it’s in excess and replenishes it when it’s in short supply. Today, people have invented a new type of stablecoins which use computer algorithms to stabilize supply and demand. This new invention is called algorithmic stablecoin (ASC).

There are three categories of stablecoins: 1. centralized stablecoins backed by fiat currencies, e.g. USDT, USDC, GUSD, PXX, etc. (This type of stablecoins has the most liquidity in the crypto market); 2. decentralized stablecoins backed by cryptocurrencies (over-collateralized), e.g. DAI, sUSD, etc.; 3. decentralized ASC based on DeFi, e.g. AMPL, BAC, ESD, etc.

The Essence of ASC

As its name suggests, ASC is a novel type of stablecoins that utilize algorithms to adjust its supply and demand in the market. When an ASC is worth more than the fiat currency that it is pegged to, the algorithm will increase its supply, and when the ASC is worth less than the fiat currency, the algorithm will reduce supply or rebalance its price through certain market manoeuvres.

Take AMPL for example. To achieve price stability, AMPL has adopted a flexible supply mechanism, adjusting supply based on demand with the help of preset algorithms in its protocol. This is to say that Ampleforth has preset rebase points for price and supply. When the price touches the upper or lower rebase point, a rebase mechanism will trigger to affect the AMPL held by all users. Rebase takes place at 10:00 a.m. (GMT+8), and it takes into consideration the volume-weighted average price (VWAP) of the past 24 hours. When this VWAP is higher than 1.05 USD, the balance in all AMPL user wallets will simultaneously increase. When the VWAP is lower than 0.95 USD, the balance in all AMPL user wallets will simultaneously decrease.

The Limitations of ASC

Similar to the consensus mechanisms of various consensus algorithms, ASC has advantages and limitations. ASC has created an alternative to traditional collateralized stablecoins. It utilizes algorithmic mechanisms to realize the decentralized issuance and circulation of currencies for the DeFi market. This arrangement does away with the inefficient supply-demand balancing of fiat-collateralized stablecoinsdue to centralization and regulatory troubles, as well as the capital waste that over-collateralized stablecoins necessitates. However, ASC still faces a “stable value paradox”, as the “rationality” of algorithms contends with the “subjectivity” of market capital. On the other hand, if, in order to achieve stability, we artificially peg the price of ASC to fiat currencies at its infancy stage, ASC will lose its natural volatility, and macro-control will get in the way of the free market.

New Opportunities for ASC

Conventionally, currencies serve three purposes: a unit for keeping account, a medium of exchange and a medium to store value. Without a doubt, ASC also fulfills all these three functions too. Popular ASCs available in the market today have drawn inspiration from the way traditional central banks work. They are priced based on the supply and demand of the market, with fixed rules substituting subjective judgment, and algorithms taking the place of centralized institutions. Algorithms determine how many stablecoins will be issued, and the price is determined by supply. This is to say that as long as we can control the number of stablecoins issued, we can control its price, and that is the core advantage and value of ASC.

Given all this, to promote the application of ASC, we need to start from its intrinsic nature and purpose.

1. Innovation of mechanisms: We should not only pay attention to innovative staking mechanisms but also to innovative algorithm adjustment mechanisms;

2. Fundamental innovations: Currently, the issuance and management of stablecoins mostly depend on Ethereum. In addition to the Ethereum Mainnet, a layer-2 network can be added to accelerate the circulation and expand the use scenarios of ASC. Liquidity and a large number of application scenarios are the only guarantee for stability for any type of stablecoins;

3. Innovation of underlying assets: USD doesn’t have to be the only underlying asset that ASCs are pegged to. Using the local currencies of different markets will make ASCs easier to use for local people. This will help expand the application scenarios and user base of ASC, thus boosting its liquidity.

APEX: Fresh Blood for the Matrix DeFi Ecosystem

APEX (AI-Powered Exchange) is a decentralized protocol based on Matrix’s AI technology, supporting the minting and cross-chain exchange of multiple algorithmic stablecoins. By integrating AI with algorithmic stablecoin, APEX will create scalable decentralized stablecoins suited for the specific needs of different countries and regions, and support the free exchange among all types of stablecoins. Here are five core features of APEX:

a. Smart Stabilization Algorithm: Users need to stake a certain number of assets to mint algorithmic stablecoins. Smart stability adjustment is dependent on both stakes and stabilization algorithms. When the ratio between algorithmic stablecoins and the currency it is pegged to is bigger than 1 on APEX, the weight of stakes will decrease, and the weight of algorithms increase. When this ratio is smaller than 1, the weight of staking will increase, and that of algorithms decrease;

b. DAO: autonomous community, featuring decentralized management;

c. Cross-chain Transaction: Since APEX supports the exchange among algorithmic stablecoins on different blockchains pegged to different fiat currencies, the platform’s cross-chain functions are fully capable of facilitating the transactions of different types of assets;

d. On-chain Oracle Machine: APEX has direct access to the real-time data of DEXs and reads the real-time exchange rates of currencies through Chainlink;

e. AI-powered Currency Exchange: AI algorithms will help find the best exchange rates for different asset types on APEX. Users may also choose to ignore these AI recommendations and use any currency exchange service they prefer.

Essentially, APEX is about two things: 1. algorithmic stablecoins geared towards individual markets, and 2. an AI-algorithm-stabilized exchange built on Matrix AI Network.

APEX: A Better Solution for DeFi

A Smart Oracle Machine

The Oracle Machine is an integral part of DeFi. It is a one-way digital proxy capable of searching for and verifying real-world data and sending them as encrypted information to smart contracts. Without the Oracle Machine, DeFi contracts will be incapable of obtaining the necessary data for operation. The Oracle Machine is mainly responsible for processing requests from smart contracts and bringing information and data from outside onto the blockchain. Therefore, the Oracle Machine can be seen as the bridge between decentralized protocols and offchain data, and it will play a crucial role in supporting the wide variety of ASCs on APEX.

However, a centralized oracle machine can create all kinds of problems. Firstly, its source of price information won’t be diversified enough, and information from a centralized source may easily be replicated, altered or intercepted. Therefore, using a single centralized data source for the Oracle Machine is not only unwise but also dangerous. Corrupted or invalid data fed into a centralized oracle machine can cause serious damage to end-users.

Secondly, offchain data are not responsive enough to price fluctuations and thus not smart enough. The reason behind this is that privileged users need to be trusted to neither commit evil on purpose nor be coerced to send corrupted updates. Trusted messages can’t be accessed by any other privileged party, meaning that even when under attack, the system can do nothing to protect itself. Without a solution to this, losses can be devastating. This is not to say, however, that the attackers’ tactics are in any way sophisticated. Such attacks are only difficult to defend against because current oracle machines are not smart enough.

By building a revolutionary AI-powered oracle system based on Matrix AI Network, APEX is hoping to supplement traditional oracle machines with the power of AI. While guaranteeing there are always multiple nodes receiving offchain data, APEX also utilizes an onchain governance program capable of auto-machine learning based on Matrix’s MANTA platform. This program will automatically adjust the weight distribution to nodes and appraise the trust level of each node.

This way, the speed and stability of the Oracle Machine will drastically improve, and APEX will be much more secure and versatile enough to handle all scenarios.

Smart ASC Trading Platform

Since APEX hosts ASCs for different countries and regions, people will frequently want to exchange one ASC into another just as in a foreign exchange market. Conventional transaction methods will have a difficult time keeping up with the volatility of niche markets, and cross-chain transactions make it even harder to secure the best prices for users.

To solve this problem, APEX will offer a cross-chain router hub to facilitate the exchange of ASCs on APEX or between APEX and other blockchain platforms. When a transaction request is launched, the Oracle Machine will snatch real-time price information from the liquidity pools on the respective blockchains of each underlying asset. The Oracle Machine will send this information to Matrix’s AI exchange protocol. Combining all information, the protocol will help users find the best price and pick the optimal transaction route. Once a transaction is confirmed, users pay with ASCs they have on one blockchain and receive ASCs on the target blockchain.

As APEX hosts multiple ASCs whose price movements create opportunities for arbitrage in a market that is open 24/7, a quantitative trading strategy tool based on Matrix AI will be provided for users who are interested in arbitrage through high-frequency trading.

Why Is ASC Significant for Matrix?

A Diversified DeFi Ecosystem

Digital assets are a crucial part of a public chain’s worth, and financial tools can boost the use and liquidity of digital assets, thus raising their value.

ASC is a fundamental part of DeFi, and APEX will lay the foundation for Matrix’s DeFi ecosystem.

Stable Pricing

AI services and computing power leasing will become Matrix’s core services. All the services on Matrix AI Network will require MAN for payment, which is expected to boost MAN’s liquidity. However, it will be difficult to commercialize these services, not to mention promote them to clients outside the crypto industry, if the services are priced in a volatile currency. The fluctuating price of MAN could become a barrier for ordinary corporate clients or individual users who may otherwise be interested in the services and computing power Matrix offers.

Therefore, to provide users a streamlined experience, Matrix will need to introduce stablecoins to price its services. Although USDT could be a good choice, it is a centralized stablecoin and thus at odds with our ideal for a decentralized platform. There may also be unforeseen risks associated with centralized assets, and truly decentralized stablecoins are the solution.

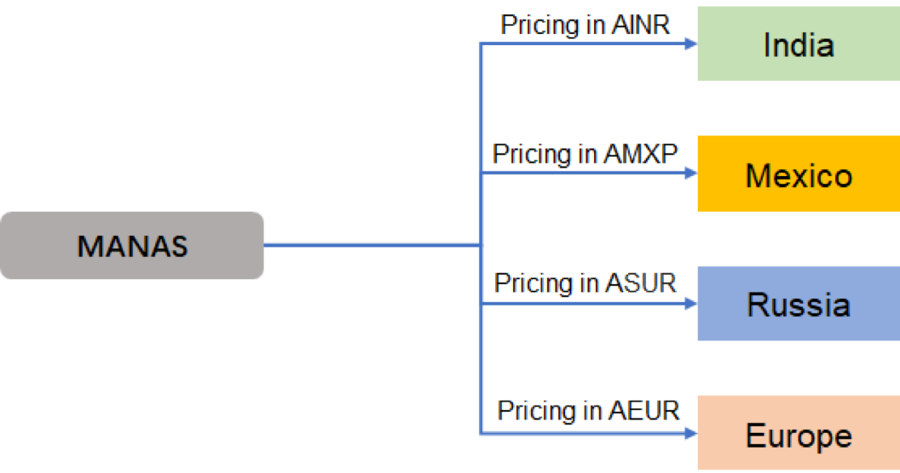

Take the Indian market as an example. Services on MANAS will be priced in AINR in India. When users want to buy services on MANAS, they pay in AINR, and the system will automatically convert the AINR into MAN through DEX. This payment will go into the accounts of all providers of algorithms and computing power necessary for running this service. This solution removes the entry barrier for users and guarantees the liquidity of MAN.

A Broader Market

APEX sets precedence by offering country/region-specific ASCs suited for local users’ needs. By adopting APEX ASCs for the pricing and settlement of services on Matrix, we lower the barrier for people in different markets to take advantage of what Matrix has to offer.

Fresh Blood for Matrix

The broad market access of APEX is a strength in building a global community and user base, and the partnership with APEX will also channel fresh blood into Matrix’s ecosystem. This will not only be limited to user growth, but APEX’s influence in different countries and regions may bring more side benefits for Matrix. For instance, with the promotion of AINR in India, the country’s reservoir of AI scientists could add to MANAS’s pool of AI talents and services.

AI + DeFi = Endless Possibilities

The integration with APEX will fill up a gap in Matrix’s DeFi ecosystem. While thanks to Matrix, APEX too will gain unprecedented momentum from the synergy of AI and DeFi.

This ecosystem will have the potential of spawning many unique and flexible DeFi products.

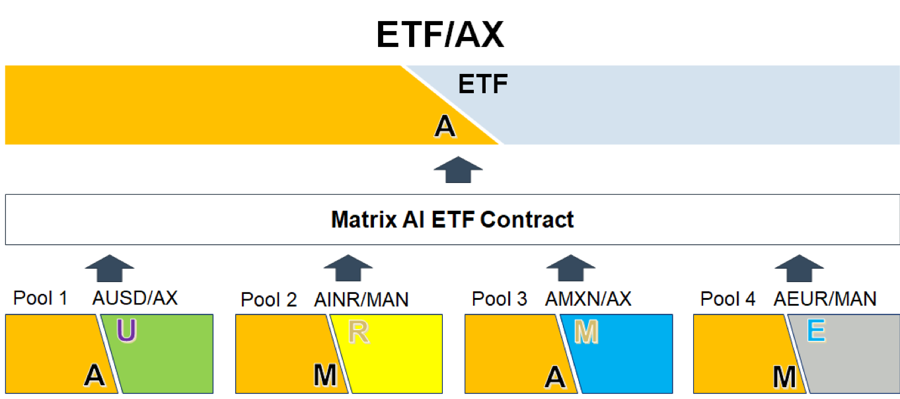

For instance, an AI-based ETF:

Or an AI-based modularized DeFi derivative platform:

Starting from the integration of AI and DeFi, Matrix and APEX will pioneer the next round of explosive growth of the DeFi market.

Last updated